Unlock Your Wealth: The Power of Compound Interest

The Power of Compound Interest: How to Grow Your Personal Wealth Over Time hinges on reinvesting earnings, allowing your initial investment to grow exponentially, offering a powerful strategy for long-term financial success.

Discover the power of compound interest: how to grow your personal wealth over time. This financial principle can be a game-changer, transforming modest savings into substantial wealth through consistent returns.

Understanding the Magic of Compound Interest

Compound interest is often called the eighth wonder of the world, and for good reason. It’s a fundamental concept in personal finance that can significantly amplify your wealth over time.

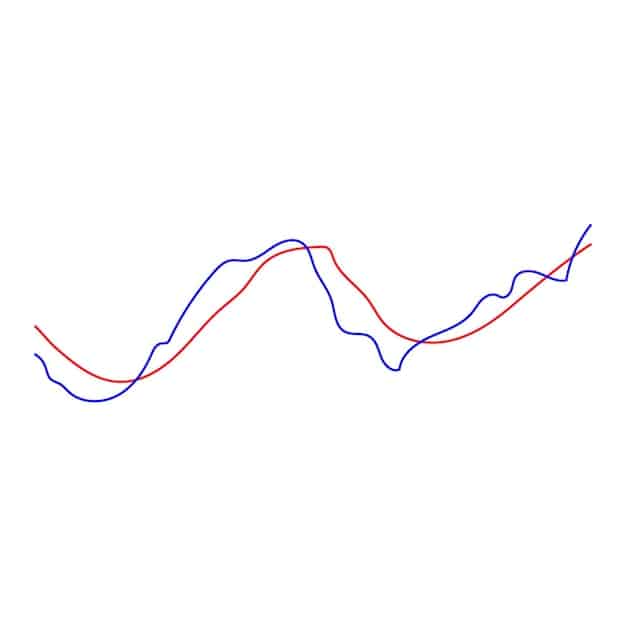

Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on the principal amount plus the accumulated interest. This means that you’re earning interest on your interest, leading to exponential growth.

The Difference Between Simple and Compound Interest

To truly appreciate the power of compound interest, it’s crucial to understand how it differs from simple interest. Simple interest is straightforward, while compound interest builds upon itself.

- Simple Interest: Calculated on the principal amount only. For example, if you invest $1,000 at a 5% simple interest rate, you’ll earn $50 each year.

- Compound Interest: Calculated on the principal amount plus the accumulated interest. If you invest $1,000 at a 5% compound interest rate, you’ll earn $50 in the first year. In the second year, you’ll earn interest on $1,050, resulting in $52.50 in interest.

The difference might seem small at first, but over time, the impact of compound interest becomes substantial.

Key Components of Compound Interest

Several factors contribute to the effectiveness of compound interest. Understanding these components can help you maximize your returns.

- Principal Amount: The initial sum of money you invest. The larger the principal, the greater the potential for growth.

- Interest Rate: The percentage return on your investment. Higher interest rates lead to faster growth.

- Compounding Frequency: How often the interest is calculated and added to the principal. The more frequent the compounding, the higher the returns. Common compounding frequencies include daily, monthly, quarterly, and annually.

- Time Horizon: The length of time you allow your investment to grow. The longer the time horizon, the more significant the impact of compound interest.

In summary, compound interest involves earning returns not only on your initial investment but also on the accumulated interest, creating an exponential growth effect.

Why Start Investing Early?

One of the most significant advantages you can give yourself when it comes to compound interest is time. Starting early allows your investments more time to grow, leading to potentially larger returns.

The concept of time being an ally in investing is crucial. Even small amounts invested early can outgrow larger amounts invested later due to the compounding effect.

The Power of Time: An Example

To illustrate this point, consider two investors, Sarah and Tom. Sarah starts investing $200 per month at age 25, while Tom starts investing $400 per month at age 35. Both earn an average annual return of 7%.

By age 65, Sarah would have invested a total of $96,000, and her investment would have grown to approximately $650,000. Tom would have invested a total of $144,000, but his investment would only have grown to approximately $550,000. Even though Tom invested more money, Sarah’s earlier start allowed her to accumulate more wealth.

The Impact of Delaying Investment

Delaying investment affects not only the final amount but also the potential returns. The longer you wait, the more you need to invest to catch up.

Think of it as planting a tree. The sooner you plant it, the more time it has to grow. Delaying planting means missing out on valuable growth opportunities. Similarly, investing early allows your money to grow steadily over time due to compound interest.

Turning Small Amounts Into Large Returns

Starting early doesn’t necessarily require large initial investments. Even small, consistent contributions can result in substantial returns over time.

For instance, consider investing just $5 a day. Over 40 years, with a 7% annual return, this could grow to over $200,000. The key is consistency and allowing the magic of compounding to work its wonders.

Starting early maximizes the benefits of compound interest, allowing even small investments to grow significantly over time.

Choosing the Right Investment Accounts

Selecting the appropriate investment accounts is essential for maximizing compound interest benefits. Different types of accounts offer varying tax advantages and growth opportunities.

Understanding the features and benefits of various accounts is crucial to making informed decisions.

Tax-Advantaged Accounts

Tax-advantaged accounts can significantly enhance the power of compound interest by allowing investments to grow tax-free or tax-deferred.

- 401(k) Plans: Employer-sponsored retirement plans that offer tax-deferred growth. Contributions are made before taxes, and earnings grow tax-free until retirement.

- Individual Retirement Accounts (IRAs): Retirement accounts that offer tax advantages. Traditional IRAs provide tax-deferred growth, while Roth IRAs offer tax-free growth.

- 529 Plans: Savings plans for education that offer tax advantages. Earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free.

Brokerage Accounts

Brokerage accounts offer flexibility and access to a wide range of investment options, including stocks, bonds, and mutual funds. While they don’t offer the same tax advantages as retirement accounts, they can be valuable for long-term investing.

Additionally, certain brokerage accounts allow for dividend reinvestment, which is a great tool for compounding wealth over time.

How to Align Your Choices

Consider your financial goals, risk tolerance, and tax situation when choosing investment accounts. Diversification is key.

For example, prioritize tax-advantaged accounts like 401(k)s and IRAs for retirement savings, and use brokerage accounts for other long-term investments. By selecting the right investment accounts, you can optimize the benefits of compound interest.

Strategies to Maximize Compound Interest

To truly harness the power of compound interest, consider implementing certain strategies. These techniques can help you increase your returns and accelerate your wealth-building process.

Combining effective strategies with consistent investing can lead to impressive results.

Reinvest Dividends and Earnings

One of the most effective strategies for maximizing compound interest is to reinvest dividends and earnings. Rather than taking the cash, reinvest it back into the investment.

This creates a snowball effect, as the reinvested earnings generate further returns, leading to exponential growth. Many brokerage accounts offer the option to automatically reinvest dividends and earnings.

Increase Your Contributions Over Time

Gradually increasing your contributions over time can have a significant impact on your long-term returns. As your income increases, consider increasing your investment contributions accordingly.

- Set Realistic Goals: Start with a manageable contribution amount and gradually increase it over time.

- Automate Contributions: Set up automatic transfers from your bank account to your investment accounts.

- Take Advantage of Employer Matching: If your employer offers a matching contribution to your 401(k) plan, be sure to take full advantage of it.

Be Patient: Consistency is Key

Compound interest is a long-term game, and patience is essential. Avoid making impulsive decisions based on short-term market fluctuations.

Staying consistent and allowing your investments to grow over time is crucial. Remember, the longer you stay invested, the greater the impact of compound interest will be.

Combining reinvestment, increased contributions, and patience can help you unlock the full potential of compound interest.

Common Mistakes to Avoid

While compound interest is a powerful wealth-building tool, it’s essential to avoid common mistakes that can hinder your progress.

Being aware of these pitfalls can help you stay on track and maximize your returns.

Withdrawing Earnings Prematurely

One of the biggest mistakes you can make is withdrawing earnings prematurely. This not only reduces your principal amount but also disrupts the compounding process.

Withdrawing earnings to spend on non-essential items can significantly impact your long-term financial goals. Avoid this temptation and allow your investments to grow uninterrupted.

Failing to Reinvest Dividends

As mentioned earlier, reinvesting dividends is crucial for maximizing compound interest. Failing to do so is a missed opportunity to accelerate your wealth-building process.

Ensure that you have set up your investment accounts to automatically reinvest dividends and earnings.

Underestimating the Impact of Fees

Fees can eat into your returns and reduce the benefits of compound interest. Be mindful of the fees associated with your investment accounts and choose low-cost options whenever possible.

High fees can significantly impact your long-term returns. Consider index funds or ETFs with low expense ratios to minimize fees to help maximize the impact of compound interest.

Avoiding these common mistakes is crucial for harnessing the full potential of compound interest.

Real-Life Examples of Compound Interest

Compound interest isn’t just a theoretical concept; it’s a powerful force in the real world. Consider several real-case examples.

These examples can illustrate how compound interest works in practice and inspire you to take action.

The Story of Warren Buffett

Warren Buffett, one of the most successful investors of all time, is a prime example of the power of compound interest. He started investing at a young age and consistently reinvested his earnings, allowing his wealth to grow exponentially over time.

Buffett’s long-term investment strategy and focus on compounding have made him one of the wealthiest people in the world. His story serves as a powerful testament to the power of compound interest.

Retirement Accounts

Millions of people rely on compound interest to grow their retirement savings. By consistently contributing to 401(k)s and IRAs, they can accumulate substantial wealth over time.

These accounts offer tax advantages that further enhance the power of compound interest, making them valuable tools for retirement planning.

Real Estate Investments

Real estate investments can also benefit from compound interest. Rental income can be reinvested to purchase additional properties, leading to exponential growth.

Over time, the value of the properties may increase, further enhancing the returns. Real estate can be a powerful asset class for building wealth through compound interest.

| Key Points | Brief Description |

|---|---|

| 🌱 Start Early | Time is your best ally; begin investing as soon as possible. |

| 🔄 Reinvest | Always reinvest dividends and earnings to amplify growth. |

| ⬆️ Increase Contributions | Incrementally increase your investment contributions over time. |

| 🛡️ Avoid Fees | Minimize fees to secure better returns on investments. |

Frequently Asked Questions

▼

Its power originates from building wealth through reinvesting profits, generating earnings that also yield profits on top of the original amount. With time this produces substantial growth from even modest beginnings.

▼

While not a prerequisite, basic arithmetic can help illustrate the impact through calculations. One needs an understanding of the overall process for the best implementation strategies.

▼

The answer is immediate. It should be implemented in early adulthood as the sooner an individual starts, the greater potential returns are over an extended duration which maximizes possibilities greatly over short time spans.

▼

Absolutely, consistently reinvesting profits to grow initial investments, minimizing service charges through careful selection of investment options, while allocating finances responsibly, can improve returns.

▼

To protect against setbacks: avoid early withdrawals, reinvest benefits without fail, control service fees, and choose investments wisely. Knowledge enhances financial results and helps promote gains for future security.

Conclusion

In conclusion, the power of compound interest: how to grow your personal wealth over time, is a crucial concept in personal finance. By understanding its principles, investing early, and implementing effective strategies, you can unlock its potential and achieve your long-term financial goals. Avoid common mistakes and stay consistent, and you’ll be well on your way to building substantial wealth over time.