Debt Management Strategies: A Comprehensive Guide for 2025

Debt management strategies are essential for individuals aiming to regain financial control by 2025, encompassing techniques like budgeting, debt consolidation, and credit counseling to effectively pay off personal debt and achieve financial stability.

Feeling overwhelmed by debt? Understand that you’re not alone. This comprehensive guide on debt management strategies: A comprehensive guide to paying off personal debt in 2025 provides actionable steps to help you regain control of your finances and achieve a debt-free future.

Understanding Your Debt Landscape

Before tackling debt, it is crucial to fully understand your current debt situation. This involves identifying all outstanding debts, their interest rates, and the minimum payments required.

Identifying Types of Debt

The first step is to list all debts you have, from credit card balances to student loans. Categorizing these debts can help you prioritize which ones to address first.

Calculating Total Debt

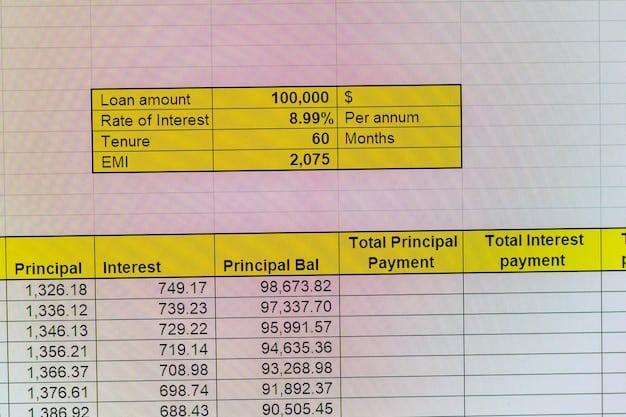

Add up all your outstanding balances to get a clear picture of the total amount you owe. Use a spreadsheet or budgeting app to keep all the information organized.

- Credit Card Debt: Typically has high interest rates and should be a priority.

- Student Loans: Can have lower interest rates but significant long-term impact.

- Personal Loans: Often used for specific purposes with fixed repayment terms.

- Mortgage: Secured debt; focusing on other debts initially might be beneficial.

Understanding the specifics of each debt allows you to create an informed strategy for debt repayment. Knowing your total debt and the types of debts you hold is fundamental for effective planning.

Creating a Realistic Budget

Budgeting is the cornerstone of any successful debt management strategy. It provides a clear overview of your income and expenses, enabling you to identify areas where you can cut back and allocate more funds towards debt repayment.

Tracking Income and Expenses

Start by recording your income from all sources. Then, track your expenses for a month to see where your money is going. Use budgeting apps or spreadsheets to organize your financial data.

Identifying Areas to Cut Back

Once you have a clear picture of your spending habits, identify areas where you can cut back. Common areas include dining out, entertainment, and non-essential subscriptions.

- Review your subscriptions and cancel those you don’t use regularly.

- Plan your meals and cook at home to reduce dining expenses.

- Look for free or low-cost entertainment options in your community.

A well-crafted budget not only helps you pay off debt faster but also provides a framework for long-term financial health. Being realistic about your income and expenses is key to creating a sustainable budget.

Debt Snowball Method

The debt snowball method, popularized by Dave Ramsey, focuses on paying off the smallest debts first to gain momentum and motivation. This approach can be particularly effective for people who need psychological wins to stay on track.

Listing Debts from Smallest to Largest

Start by listing all your debts from the smallest balance to the largest, regardless of interest rate. Focus on paying off the smallest debt first while making minimum payments on the others.

Gaining Momentum

Once you’ve paid off the smallest debt, use the money you were putting towards it to pay off the next smallest debt. This creates a “snowball” effect, as the amount you’re paying off increases.

- Focus on one debt at a time for maximum impact.

- Celebrate small victories to stay motivated.

- Adjust the snowball as income or expenses change.

The debt snowball method is less about mathematical optimization and more about behavioral economics. Its focus on quick wins can provide the motivation needed to tackle larger debts successfully. Consider this approach if you find yourself getting easily discouraged.

Debt Avalanche Method

The debt avalanche method prioritizes paying off debts with the highest interest rates first. This strategy minimizes the total amount of interest paid over the long term, making it an efficient approach for those who are disciplined and mathematically inclined.

Listing Debts by Interest Rate

List your debts from the highest interest rate to the lowest. Focus your efforts on paying off the debt with the highest rate first while making minimum payments on the others.

Minimizing Interest Paid

By targeting high-interest debts first, you reduce the amount of interest accruing on your balances, which can save you a significant amount of money over time.

Considerations

The debt avalanche method requires discipline as it might take longer to see initial progress. Stay focused on the long-term financial benefits to stay motivated.

The debt avalanche method is optimal for those who can stay disciplined and focused on long-term financial goals. Its mathematical advantage can lead to significant savings, making it a worthwhile strategy for many.

Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single new loan or payment plan, often with a lower interest rate or more manageable terms. It can simplify your finances and potentially save you money.

Personal Loans

Consider taking out a personal loan to consolidate your debts. These loans typically have fixed interest rates and repayment terms, making budgeting easier.

Balance Transfer Credit Cards

Look for balance transfer credit cards offering low or 0% introductory interest rates. Transferring your high-interest balances to these cards can save you money on interest charges, but be mindful of transfer fees and promotional periods.

Home Equity Loans

If you own a home, a home equity loan allows you to borrow against the equity in your home. These loans often have lower interest rates than other types of debt, but they are secured by your home, so be cautious.

- Research rates and fees from multiple lenders.

- Understand the terms and conditions of the loan.

- Consider the long-term impact on your finances.

Debt consolidation can be a powerful tool for simplifying your finances and reducing interest costs. However, it’s crucial to research your options thoroughly and ensure that you understand the terms and conditions of any new loan or credit card. Choose wisely to avoid adding to your financial burden.

Seeking Professional Help

If you’re struggling to manage your debt on your own, seeking professional help can provide you with the guidance and support you need. Credit counseling agencies and financial advisors can offer valuable assistance.

Credit Counseling Agencies

Non-profit credit counseling agencies can provide free or low-cost advice on budgeting, debt management, and credit repair. They can also help you negotiate with creditors to lower interest rates or set up payment plans.

Financial Advisors

Financial advisors can provide personalized guidance on debt management, investment strategies, and long-term financial planning. They can help you create a comprehensive plan to achieve your financial goals.

Debt Management Plans (DMPs)

A DMP involves working with a credit counseling agency to create a structured repayment plan. The agency negotiates with your creditors to reduce interest rates and monthly payments, making your debts more manageable.

Seeking professional help can be a crucial step in regaining control of your finances. Whether you choose to work with a credit counseling agency or a financial advisor, their expertise can provide you with the tools and support you need to successfully manage your debt and achieve financial stability.

| Key Point | Brief Description |

|---|---|

| 📊 Budgeting | Track income and expenses to find areas for saving and debt repayment. |

| ❄️ Debt Snowball | Pay off smallest debts first for quick wins and motivation. |

| 💡 Consolidation | Merge debts into one for easier management and potentially lower interest. |

| 🤝 Professional Help | Seek advice from credit counselors for personalized strategies. |

FAQ

▼

The first step is to assess all your debts, including the amount owed, interest rates, and minimum payments, to understand your overall debt situation.

▼

The debt snowball method involves paying off your smallest debts first, regardless of interest rate, to build momentum and stay motivated.

▼

Debt consolidation can simplify your finances by combining multiple debts into one and potentially lower your interest rate, saving you money.

▼

You should seek professional help if you’re struggling to manage your debt on your own or if you feel overwhelmed by your financial situation.

▼

Budgeting allows you to track your income and expenses, identify areas where you can cut back, and allocate more funds towards debt repayment.

Conclusion

Mastering debt management strategies is essential for paving the way to financial freedom in 2025. By understanding your debt, creating a realistic budget, and implementing effective repayment methods, you can take control of your finances and achieve a debt-free future.