Personal Budgeting Apps: Find the Right One for You

Personal budgeting apps help you track spending, save money, and achieve financial goals by providing tools for creating budgets, monitoring transactions, and analyzing financial data, but selecting the best app requires careful consideration of individual needs and preferences.

Are you looking for a way to better manage your finances? Personal budgeting apps are powerful tools that can help you track your spending, create realistic budgets, and achieve your financial goals. With so many options available, finding the right app can feel overwhelming. This guide will help you navigate the world of budgeting apps and discover the perfect fit for your needs.

Understanding the Basics of Personal Budgeting Apps

Personal budgeting apps have revolutionized how individuals manage their money by providing immediate access to financial data and control. These apps range from simple expense trackers to comprehensive financial management platforms, making personal finance more accessible and less intimidating.

Understanding the different types of budgeting apps available can help you choose the one that best suits your financial style and goals. Whether you’re looking for detailed analysis or a quick overview of your spending, there’s an app designed for you.

Key Features of Budgeting Apps

Most budgeting apps offer a range of features designed to simplify financial management.

- Expense Tracking: Automatically categorize and track your spending habits.

- Budget Creation: Set up monthly or weekly budgets and monitor your progress.

- Goal Setting: Define and track savings goals for specific purchases or milestones.

- Financial Reporting: Generate reports to analyze spending patterns and identify areas for improvement.

The features that resonate best with you will depend on your needs and engagement style.

The Benefits of Using a Budgeting App

There are several advantages to using a budgeting app. These apps not only provide real-time insights into your financial habits, but they also encourage proactive financial management and decision-making.

By centralizing your financial information, budgeting apps make it easier to stay on top of your finances and work toward your financial goals.

Increased Financial Awareness

Budgeting apps provide a clear picture of where your money is going, helping you identify areas where you can cut back and save more.

Improved Budget Adherence

By tracking your spending against your budget in real-time, you’re more likely to stay within your limits and avoid overspending.

Achieving Financial Goals

Setting and tracking financial goals motivates you to save and invest, ultimately leading to greater financial security.

Ultimately, the purpose is to guide you toward your financial goals in the most efficient way possible.

Top Personal Budgeting Apps on the Market

Here’s a look at some of the most popular personal budgeting apps available, each offering unique features and benefits.

The following options represent some of the best budgeting apps available. Whether you are looking for simplicity or high-level detail, an app is sure to fit your needs.

- Mint: A free app that offers comprehensive budgeting, expense tracking, and bill payment reminders.

- YNAB (You Need A Budget): A subscription-based app that encourages you to allocate every dollar to a specific purpose.

- Personal Capital: A free app for net worth tracking and investment management with advanced features.

Each app has its own set of strengths, making it essential to evaluate your needs and preferences.

Factors to Consider When Choosing an App

When selecting a personal budgeting app, there are several factors you should consider to ensure it aligns with your financial management style and needs.

Choosing the right app will ultimately help you gain the most from your efforts. Evaluate each factor based on your own lifestyle and goals.

User Interface and Ease of Use

A user-friendly interface is crucial for maintaining consistency in your budgeting efforts.

Security and Privacy

Ensure the app uses strong encryption and protects your financial data.

Integration with Financial Institutions

Seamless integration with your bank accounts and credit cards streamlines expense tracking.

Choose your app wisely based on these factors to streamline your journey to financial health.

Setting Up Your Budgeting App

Setting up your budgeting app is an essential step in achieving your financial goals.

Once you’ve selected your app, it’s time to set it up and begin using all its features.

Linking Your Accounts

Connect your bank accounts, credit cards, and other financial accounts to the app for automatic transaction tracking.

Creating a Budget

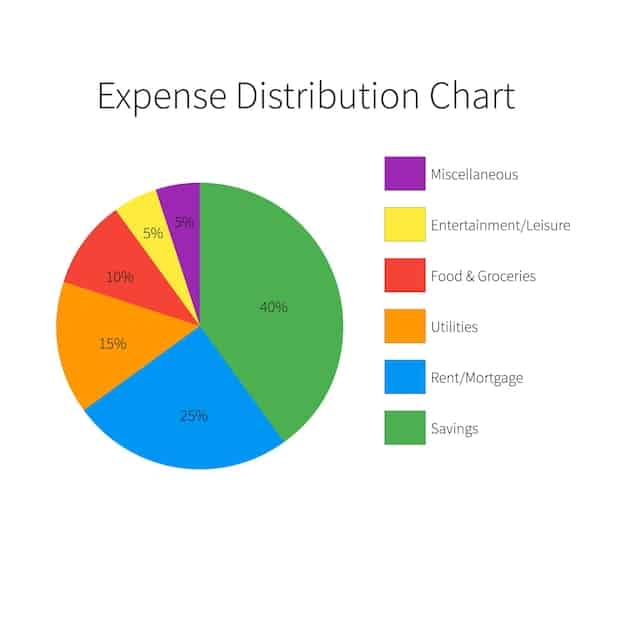

Set up your budget by categorizing your income and expenses and allocating funds for each category, like food, home, and utilities.

Customizing Settings

Customize your app settings to meet specific financial goals and preferences. Set alerts for important reminders.

Set up can initially take some time, but the long-term benefits are well worth it.

Tips for Maximizing Your Budgeting App

To truly make the most of your budgeting app, cultivate good habits and actively engage with the app regularly.

In addition to setting up your app, there are several strategies you can employ to boost results.

- Regularly Review Your Budget: Periodically review your budget to make necessary adjustments.

- Track Your Spending Daily: Track expenses to stay on top of unexpected spending.

- Automate Savings: Automate the process of adding money to savings.

These tips are all about establishing a regular routine to enhance accuracy and promote financial accountability.

| Key Aspect | Brief Description |

|---|---|

| 💰 Budgeting | Create a personalized budget to track your spending and savings goals. |

| 📊 Tracking | Monitor your income and expenses to identify spending patterns. |

| 🎯 Goals | Set specific savings goals, like a down payment on a home. |

| 🛡️ Security | Use apps with strong security measures to protect your banking data. |

Frequently Asked Questions

A personal budgeting app is a tool designed to help individuals track their income and expenses, create realistic budgets, and achieve financial goals by managing their money more effectively.

Most reputable budgeting apps use encryption and security measure to protect your data. Always check the app’s security features and privacy policy before linking your accounts.

Yes, budgeting apps can significantly improve your financial habits. By providing clear insights into your spending and automating tracking, they make it easier to adhere to budgets and achieve goals.

Assess your financial management style, consider your budget goals, think about your security needs, and any specific features you want. Read reviews, compare pricing, and try free trials.

Many budgeting apps offer free versions with basic features. However, premium features, like advanced analytics or investment tracking, may require you to pay a subscription fee.

Conclusion

Choosing the right personal budgeting app and implementing smart financial management strategies can transform your financial well-being. By actively tracking your spending, creating realistic budgets, and achieving financial goals, you’ll empower yourself to make informed decisions and secure your financial future.