Tax credits for education: unlock savings today

Tax credits for education significantly reduce the cost of higher education by providing financial benefits to eligible students, helping to lessen the overall tax burden associated with educational expenses.

Tax credits for education can offer valuable savings for students and families. Have you ever wondered how these credits work? This article dives into the types, benefits, and application process for education-related tax credits.

Understanding tax credits for education

Understanding tax credits for education can significantly impact your financial situation. These credits are available to eligible students and their families, helping to offset the costs of higher education. In this section, we’ll delve into what these credits entail and how they can assist you in your educational journey.

What Are Education Tax Credits?

Education tax credits are benefits provided by the government that reduce the amount of tax you owe. There are generally two main types: the American Opportunity Credit and the Lifetime Learning Credit. Each credit has specific guidelines and benefits that can help you save.

Benefits of Education Tax Credits

These credits can lower your tax burden, leading to significant savings. Here are some essential benefits:

- Reduce the overall cost of education.

- Make higher education accessible.

- Support taxpayers financially during their education.

- Encourage lifelong learning.

Tax credits for education not only make a difference in your finances but also enhance the overall value of obtaining a degree. By understanding the different credits, you can maximize your savings and invest more in your future.

An important aspect of these credits is the eligibility criteria. To qualify, you must meet specific income requirements, educational status, and other criteria established by the IRS. The application process involves completing the correct tax forms and sometimes providing additional documentation.

Eligibility Requirements

Understanding eligibility is crucial for claiming these credits. Here are some factors to consider:

- Your filing status and adjusted gross income.

- Enrollment status in an eligible educational institution.

- Course load and duration of studies.

By ensuring you meet these criteria, you can avoid potential headaches when filing for these benefits. Overall, being informed about tax credits for education is a powerful step towards managing your financial future.

Types of education tax credits

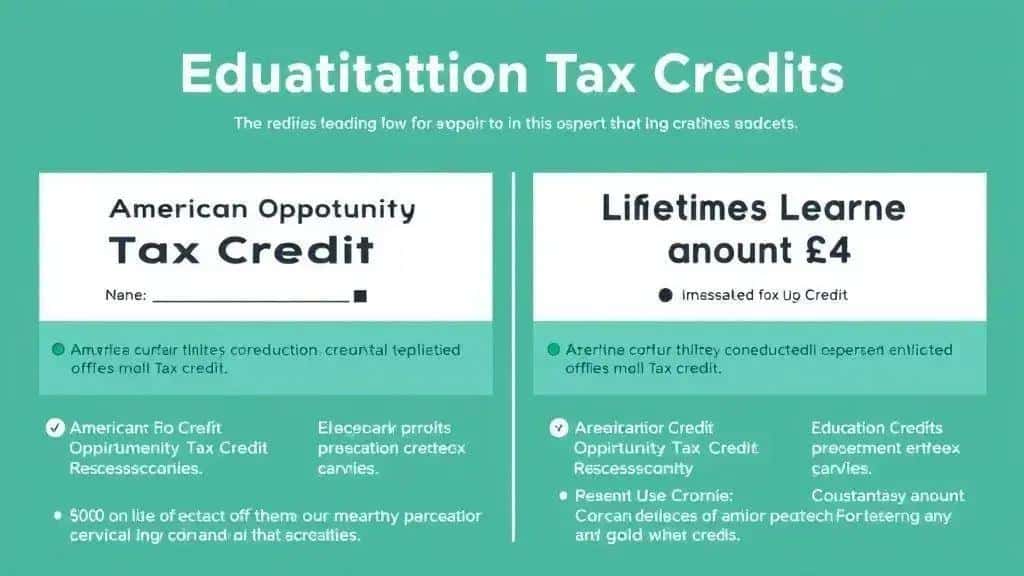

When exploring tax credits for education, it’s essential to understand the different types available. There are two primary education tax credits that can help you save money and make education more affordable.

American Opportunity Tax Credit

The American Opportunity Tax Credit is designed for students pursuing higher education. This credit can provide significant savings for taxpayers. Qualifying students can receive up to $2,500 per year for tuition, fees, and course materials. The best part is that 40% of this credit is refundable, meaning you could get money back even if you owe no taxes.

Lifetime Learning Credit

The Lifetime Learning Credit is another option that allows for flexibility. Unlike the American Opportunity Credit, it covers a wider range of educational pursuits. You can claim up to $2,000 per tax return for qualified tuition and expenses for any post-secondary education. This credit applies even if you are taking just one course to improve your skills.

Both credits have specific eligibility requirements based on factors such as income and enrollment status. It’s essential to review these criteria before filing your taxes.

Aside from these two main credits, many states also offer local education tax credits. These can further reduce your tax bill, making education more affordable. Be sure to check with your state’s tax agency for more information on local credits.

- Understand the benefits of each type of credit.

- Be aware of income limits and eligibility.

- Keep track of your educational expenses to maximize your claim.

- Research state-specific education tax credits available for residents.

In summary, knowing the different types of education tax credits can guide you in making informed decisions about your education financing. Understanding these credits enhances your ability to manage educational costs effectively.

Eligibility requirements for tax credits

Understanding the eligibility requirements for tax credits is crucial for making the most of your education savings. Each tax credit has specific criteria you need to meet to claim them successfully. If you are considering applying for education tax credits, you’ll want to know what qualifies you.

American Opportunity Tax Credit Eligibility

To qualify for the American Opportunity Tax Credit, you need to meet certain conditions. First, you must be enrolled at least half-time in a degree or certificate program for the tax year. This credit is only for the first four years of higher education. Additionally, your income must fall below the threshold set by the IRS, which typically changes each year.

Lifetime Learning Credit Eligibility

The Lifetime Learning Credit has more flexible guidelines. You can qualify even if you are taking just one class or enrolled in a degree program. To be eligible, you must also meet income limits, which are evaluated annually. This credit is available for an unlimited number of years, making it a great option for lifelong learners.

For both credits, you need to pay qualified education expenses, which may include tuition, fees, and course materials required for enrollment. Scholarships and grants that cover these costs may affect your eligibility, so be mindful of how they factor in.

- Check IRS guidelines for updated income limits each year.

- Ensure that your educational institution is eligible.

- Keep documentation, like Form 1098-T, to support your claims.

- Review any state-specific requirements if applicable.

In summary, by understanding the eligibility requirements for education tax credits, you can maximize your potential savings on your education. Staying informed helps you navigate the process smoothly, ensuring you take advantage of these financial benefits.

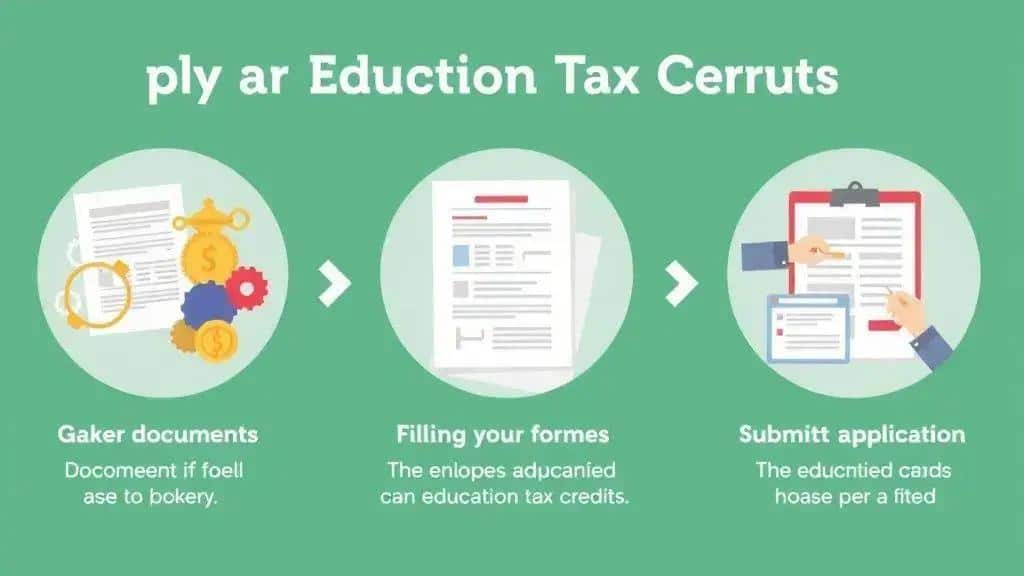

How to apply for education tax credits

Applying for education tax credits can seem overwhelming, but it becomes manageable with the right steps. The application process is straightforward and requires specific forms and documentation to prove eligibility.

Gather Necessary Documentation

The first step in applying is to gather all necessary documents. This includes Form 1098-T, which is issued by your educational institution. This form shows how much you paid in tuition and fees during the tax year.

Fill Out the Correct Tax Forms

To claim education tax credits, you’ll need to fill out IRS Form 8863, which is specifically for education credits. Ensure you provide accurate information based on what you have in your documents. This form will help determine your eligibility for both the American Opportunity Credit and the Lifetime Learning Credit.

- Double-check all entries to avoid mistakes.

- Review the eligibility requirements mentioned in previous sections.

- Consider using tax software or consulting a tax professional for assistance.

After completing Form 8863, submit it along with your tax return. Make sure to keep copies of all forms and supporting documentation for your records. If filing electronically, many tax software programs automatically include Form 8863 when you enter your education expenses.

Once submitted, you will await any updates from the IRS regarding your tax return. If additional information is needed, they will contact you directly. Knowing how to apply effectively can help you take full advantage of education tax credits, making higher education more affordable.

FAQ – Frequently Asked Questions about Education Tax Credits

What are education tax credits?

Education tax credits are tax benefits that help reduce the overall cost of higher education by decreasing the amount of taxes owed.

Who qualifies for the American Opportunity Tax Credit?

To qualify, you must be enrolled at least half-time in a degree or certificate program and have a tax income below a certain threshold.

How do I apply for education tax credits?

You can apply by filling out IRS Form 8863 and submitting it with your tax return along with documentation such as Form 1098-T.

What expenses can be covered by education tax credits?

Eligible expenses often include tuition, fees, and course materials required for enrollment at an eligible educational institution.