Understanding Your Credit Report: Dispute Errors & Improve Your Score

Understanding your credit report is crucial for financial health; this article guides you on how to dispute errors and take steps to improve your credit score effectively. Your credit report is a key component of your financial life. Understanding your credit report: How to dispute errors and improve your score, is a vital step toward […]

Investing in Real Estate: Your Beginner’s Guide to Personal Property

Investing in real estate offers a pathway to financial security, providing both passive income and long-term appreciation, suitable for beginners aiming to build wealth through personal property investments. Embarking on the journey of investing in real estate can seem daunting, but with the right knowledge and strategy, it’s an achievable goal for beginners. This guide […]

Financial Planning: Your Roadmap to Personal Goals

Financial planning provides a structured approach to managing your finances, enabling you to set and achieve personal goals such as homeownership, retirement, or education by aligning your resources with your objectives. The importance of financial planning: How to achieve your personal goals cannot be overstated in today’s complex world. It’s not just about saving money; […]

Maximize Your Standard Deduction in 2025: A Complete Tax Guide

How to Maximize Your Standard Deduction in 2025: A Tax Planning Guide provides valuable insights into understanding the standard deduction, exploring strategies to increase it, and highlighting tax planning tips to optimize your overall tax liability for the upcoming year. Navigating tax season can often feel overwhelming, especially when trying to understand the various deductions […]

How to Negotiate a Better Salary: Boost Your Income

Negotiating a better salary involves researching industry standards, knowing your worth, practicing negotiation techniques, and being prepared to justify your request with concrete examples of your accomplishments and contributions. Want to increase your personal income? Learning how to negotiate a better salary: increasing your personal income is a crucial skill that can significantly impact your […]

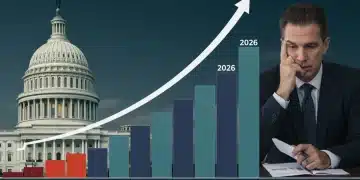

Maximize Retirement Savings: Tax Planning for 401(k) & IRA in 2025

Tax planning for retirement is crucial to minimize taxes on 401(k) and IRA distributions in 2025, involving strategies like Roth conversions, strategic withdrawals, and understanding required minimum distributions to optimize your financial future. Planning your retirement involves more than just saving; it’s also about strategically managing your taxes. Effective tax planning for retirement: strategies to […]