Childcare assistance programs: how to access support

Childcare assistance programs are crucial for working families seeking financial help. Find out how to access these valuable resources.

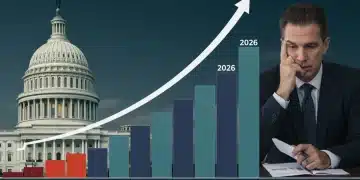

Federal Reserve interest rates: what you need to know

Federal Reserve interest rates are crucial for the economy. Learn how they affect your finances and the market.

Capital gains tax planning: strategies you need to know

Capital gains tax planning is essential for maximizing your investments. Discover effective strategies to minimize your tax burden.

Unemployment benefits updates: what you need to know

Unemployment benefits updates are crucial for those affected. Stay informed and find out how changes may impact your situation.

Inflation impact on consumers: what you need to know

Inflation impact on consumers affects daily expenses and purchasing power. Understand how to navigate these changes effectively.

Self-employed tax filing: simplify your process today

Self-employed tax filing doesn't have to be complicated. Discover tips to streamline your tax preparation and maximize your deductions.