Year-End Tax Strategies: Optimize Charitable Contributions for a 10% Tax Break

Maximizing year-end charitable contributions by December 31st is a powerful tax strategy, potentially yielding a 10% tax break through strategic planning and understanding IRS regulations.

As the year draws to a close, many individuals and families consider their financial moves, and among the most impactful are their charitable contributions. Understanding how to optimize your year-end charitable contributions by December 31st can not only support causes you care about but also potentially secure a significant tax break, sometimes as much as 10% or more of your adjusted gross income (AGI) depending on your specific circumstances and the type of contribution. This guide will explore effective strategies to make the most of your generosity while maximizing your tax benefits before the year ends.

Understanding the Basics of Charitable Deductions

Before diving into advanced strategies, it’s crucial to grasp the fundamental rules governing charitable deductions. The IRS provides specific guidelines on what constitutes a deductible contribution and how much you can claim. Knowing these basics is the first step towards optimizing your year-end giving.

Generally, contributions must be made to qualified organizations to be deductible. These are typically non-profit organizations recognized by the IRS under Section 501(c)(3) of the Internal Revenue Code. Always verify an organization’s status before making a significant donation.

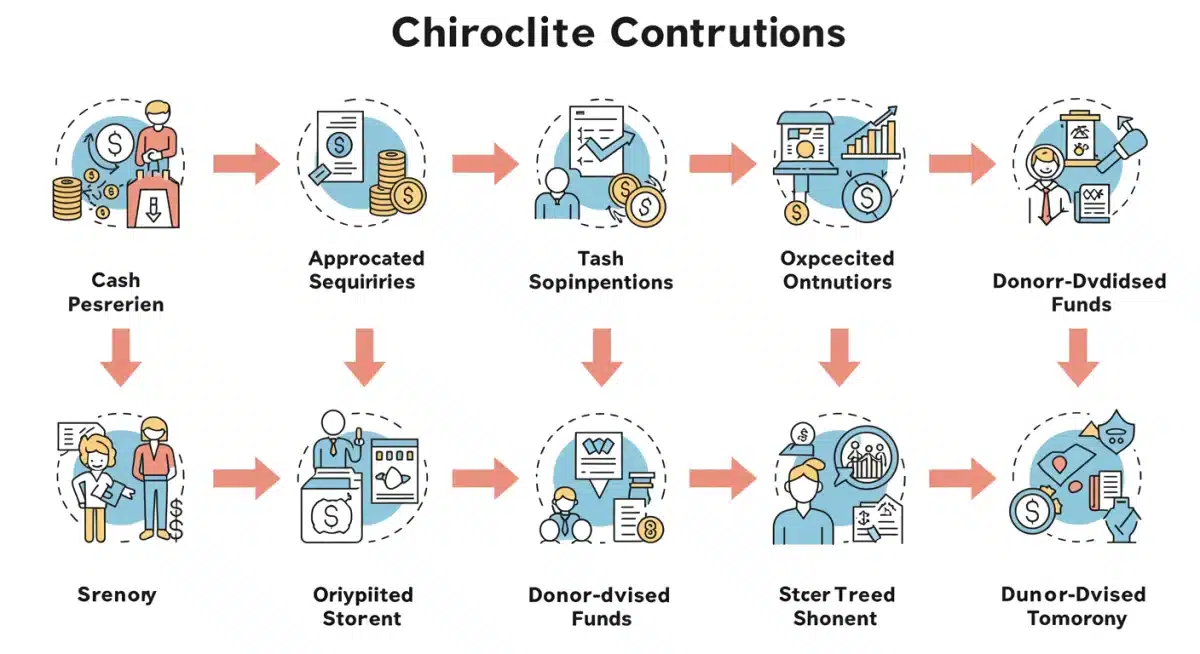

Qualified Organizations and Contribution Types

Not all organizations qualify for tax-deductible donations. It’s essential to confirm the status of your chosen charity. The IRS provides a searchable database to help taxpayers identify eligible organizations. Furthermore, the type of contribution significantly impacts its deductibility.

- Cash Contributions: These are the most straightforward and often have the highest deduction limits.

- Non-Cash Contributions: This includes appreciated securities, real estate, and tangible personal property. Their valuation and deduction limits can be more complex.

- Volunteer Services: While the value of your time is not deductible, out-of-pocket expenses incurred while volunteering may be.

The IRS imposes limits on how much you can deduct in a single tax year, typically based on a percentage of your adjusted gross income (AGI). For cash contributions to public charities, this limit is often 60% of your AGI, though temporary provisions have sometimes increased this. For non-cash contributions, limits can be lower, often 30% or 50% of AGI, depending on the asset and the charity.

Understanding these foundational rules ensures that your charitable efforts translate into the intended tax advantages. Proper documentation, including receipts and acknowledgements from the charity, is also vital for substantiating your deductions.

Maximizing Cash Contributions Before December 31st

Cash contributions remain one of the most popular and straightforward ways to give, offering significant tax benefits, especially when made strategically by the year-end deadline. For many taxpayers, the simplicity and direct impact of cash donations make them an attractive option.

The key to maximizing these deductions lies in understanding the timing and the applicable IRS limits. All cash contributions must be made by December 31st to be deductible in the current tax year. This includes donations made by check (postmarked by December 31st), credit card (charged by December 31st), or electronic funds transfer (completed by December 31st).

Strategic Giving for Higher Deductions

In recent years, temporary provisions have sometimes allowed for enhanced deductions for cash contributions. For instance, in some years, taxpayers could deduct up to 100% of their AGI for cash contributions to public charities. While these provisions vary year to year, staying informed about current tax laws is crucial.

- Bunching Deductions: If your total itemized deductions are close to the standard deduction, consider ‘bunching’ your charitable contributions into one year. This strategy involves making multiple years’ worth of donations in a single year to exceed the standard deduction threshold, then taking the standard deduction in subsequent years.

- Qualified Charitable Distributions (QCDs): For individuals aged 70½ or older, a QCD allows you to directly transfer funds from your IRA to a qualified charity. This distribution counts towards your required minimum distribution (RMD) but is not included in your gross income, offering a tax-free way to give, even if you don’t itemize deductions.

It’s important to remember that even if you don’t itemize, some temporary provisions have allowed for a limited above-the-line deduction for cash contributions. Always consult with a tax professional to understand the most current rules and how they apply to your specific financial situation. Ensuring your donations are properly documented is also paramount for any audit inquiries.

Leveraging Appreciated Securities for Greater Impact

Donating appreciated securities, such as stocks, mutual funds, or exchange-traded funds (ETFs) that you’ve held for more than one year, can be one of the most tax-efficient ways to give. This strategy offers a dual benefit: you avoid paying capital gains tax on the appreciated value of the securities, and you can deduct their fair market value on the date of the donation.

This approach is particularly advantageous if you have investments that have significantly increased in value. By donating these assets directly to charity, you bypass the capital gains tax you would incur if you sold them and then donated the cash. The charity, being tax-exempt, also avoids this tax.

How Appreciated Securities Work

When you donate appreciated stock, the amount you can deduct is generally the fair market value of the stock on the date of the gift, up to 30% of your adjusted gross income (AGI). If your donation exceeds this limit, you can carry forward the excess deduction for up to five years. This allows you to spread out the tax benefits over several years.

- Identify Long-Term Gains: Focus on assets held for over a year to qualify for favorable long-term capital gains treatment and avoid short-term capital gains.

- Direct Transfer: Ensure the securities are transferred directly from your brokerage account to the charity’s brokerage account. Do not sell the stock yourself and then donate the cash, as this would trigger capital gains tax.

- Proper Valuation: The fair market value is typically the average of the high and low trading prices on the date of the gift.

This strategy requires careful planning and coordination with your brokerage firm and the recipient charity. Initiating the transfer well before December 31st is crucial to ensure the transaction is completed within the current tax year. Delays can occur, especially during busy year-end periods, so proactive action is highly recommended to secure your deduction.

Exploring Donor-Advised Funds (DAFs) for Flexible Giving

Donor-Advised Funds (DAFs) have become an increasingly popular charitable giving vehicle, especially for individuals and families looking for flexibility, tax efficiency, and a way to simplify their philanthropic efforts. A DAF allows you to make an irrevocable contribution of cash, securities, or other assets to a public charity that sponsors the DAF. You receive an immediate tax deduction when you contribute to the DAF, and then you can recommend grants to your favorite charities over time.

One of the primary benefits of a DAF is the ability to separate the tax deduction from the actual distribution of funds. This means you can make a large contribution to your DAF by December 31st to secure your tax deduction for the current year, even if you haven’t yet decided which specific charities to support or when to make those grants.

Advantages of DAFs

DAFs offer several strategic advantages, making them a powerful tool for year-end tax planning and long-term philanthropy. They can simplify the process of giving, especially for complex assets.

- Immediate Tax Deduction: You get the tax deduction in the year you contribute to the DAF, regardless of when the grants are made to underlying charities.

- Avoid Capital Gains Tax: Similar to direct donations of appreciated securities, contributing appreciated assets to a DAF allows you to avoid capital gains tax.

- Simplified Record-Keeping: The sponsoring organization handles all the administrative duties, including investment management and record-keeping for grants.

- Flexibility and Privacy: You can recommend grants anonymously if desired, and you have the flexibility to recommend grants to various charities over many years.

DAFs are particularly useful for ‘bunching’ deductions, allowing you to contribute a larger sum in a high-income year to maximize your deduction, and then distribute those funds to charities in smaller increments over several years. This strategic approach can significantly enhance your overall tax efficiency and philanthropic impact. Ensure you establish and fund your DAF before the December 31st deadline.

Understanding AGI Limits and Carryovers

While charitable giving offers substantial tax benefits, it’s crucial to understand the Adjusted Gross Income (AGI) limits that the IRS places on deductions. These limits determine the maximum amount you can deduct in a single tax year, and they vary depending on the type of contribution and the recipient organization. Navigating these rules effectively is key to maximizing your year-end tax break.

For cash contributions to public charities, the deduction limit is generally 60% of your AGI. For non-cash contributions, such as appreciated securities, the limit is typically 30% of your AGI. Contributions to certain private foundations or other types of charities may have even lower limits. These percentages are not cumulative; they apply to each category of contribution.

Managing Excess Contributions with Carryovers

What happens if your generous contributions exceed these AGI limits in a given year? The good news is that the IRS allows you to ‘carry over’ the excess contributions. This means you can deduct the unused portion of your donation in future tax years, typically for up to five years. This carryover provision is a critical component of strategic tax planning, especially for large donations.

- Track Your Contributions: Maintain meticulous records of all your charitable donations, including the type of asset, its value, and the recipient charity.

- Calculate AGI Annually: Your AGI can fluctuate, so understanding it each year is essential for calculating your deduction limits.

- Plan Multi-Year Giving: If you anticipate a large donation that will exceed your AGI limits, plan to utilize the carryover provision over several years. This can be particularly effective with DAFs.

Properly tracking and applying carryover amounts can be complex, and errors can lead to missed deductions or IRS scrutiny. It is always advisable to consult with a qualified tax advisor to ensure you are correctly applying the AGI limits and maximizing your carryover benefits. This professional guidance helps ensure compliance and optimizes your tax position year after year.

Documentation and Record-Keeping for Tax Compliance

Effective charitable giving for tax purposes extends beyond making the donation; it crucially involves meticulous documentation and record-keeping. The IRS requires specific records to substantiate your deductions, and failing to provide adequate proof can result in disallowed deductions, even if your contributions were legitimate. This attention to detail is paramount for compliance and peace of mind.

For every contribution, regardless of its size or type, you should obtain and keep a record from the charitable organization. This record, often called an acknowledgment letter or receipt, should include the name of the organization, the date of the contribution, and the amount of cash or a description of any non-cash property contributed. For donations over a certain threshold, additional information may be required.

Key Documentation Requirements

The IRS has different documentation requirements based on the amount and type of your charitable contribution. Understanding these specific requirements will help you prepare for tax season and avoid potential issues.

- Cash Contributions Under $250: A bank record (canceled check, bank statement) or a written communication from the charity is sufficient.

- Cash Contributions of $250 or More: A written acknowledgment from the charity stating the amount of the cash contribution and whether the charity provided any goods or services in return for the contribution.

- Non-Cash Contributions Under $250: A written record of the contribution, including the name of the charity, date, and a description of the property.

- Non-Cash Contributions of $250 to $500: Same as above, plus a written acknowledgment from the charity.

- Non-Cash Contributions Over $500: In addition to the above, you must complete IRS Form 8283, “Noncash Charitable Contributions.”

- Non-Cash Contributions Over $5,000: Requires a qualified appraisal, typically to be attached to Form 8283.

Maintaining an organized system for your charitable giving records throughout the year is highly recommended. This could involve a physical folder, digital files, or specialized software. Being prepared with all necessary documentation ensures a smooth tax filing process and helps you confidently claim all eligible deductions. Remember, the burden of proof rests with the taxpayer.

The Deadline: Why December 31st Matters

The significance of December 31st in year-end tax planning, particularly for charitable contributions, cannot be overstated. This date marks the absolute cutoff for contributions to be counted for the current tax year. Any donation made or completed on or after January 1st will be applied to the subsequent tax year, impacting your immediate tax benefits.

For many taxpayers, the scramble to make last-minute donations before the clock strikes midnight on New Year’s Eve is a familiar ritual. However, understanding the nuances of how various types of contributions are deemed ‘completed’ by the IRS is crucial to avoid disappointment and ensure your generosity aligns with your tax goals.

Ensuring Your Contribution Counts

Different methods of donation have specific criteria for when they are considered completed for tax purposes. Being aware of these rules can prevent common mistakes and ensure your contribution is credited to the correct tax year.

- Checks: A check is considered delivered on the date you mail it, provided it’s postmarked by December 31st.

- Credit Cards: A charge to your credit card is deductible in the year the charge is made, even if you don’t pay the credit card bill until the next year. The transaction must be processed by December 31st.

- Electronic Funds Transfers (EFTs): For EFTs, the transfer must be completed by December 31st. Verify with your bank or the charity that the transaction is processed before the deadline.

- Stock Certificates: If you deliver a stock certificate to a charity or its agent, the donation date is the date of delivery. If you mail it, the date of mailing is generally the date of contribution. For electronic transfers, the date the stock is transferred into the charity’s account is the contribution date.

It’s always prudent to initiate complex transactions, such as stock transfers or setting up a Donor-Advised Fund, well in advance of the deadline. The closer you get to December 31st, the higher the risk of processing delays due to financial institution closures, charity staff availability, or general holiday season backlogs. Plan ahead to ensure your charitable intent translates into timely tax advantages.

| Key Strategy | Brief Description |

|---|---|

| Cash Contributions | Direct donations by December 31st, often deductible up to 60% of AGI, with potential for higher limits in certain years. |

| Appreciated Securities | Donate stocks held over a year to avoid capital gains tax and deduct fair market value. |

| Donor-Advised Funds (DAFs) | Contribute by year-end for an immediate tax deduction, then recommend grants over time. |

| AGI Limits & Carryovers | Understand annual deduction limits and utilize the five-year carryover for excess contributions. |

Frequently Asked Questions About Year-End Charitable Giving

The primary benefit is securing an immediate tax deduction for the current tax year. Contributions made by this deadline can reduce your taxable income, potentially lowering your overall tax liability and increasing your refund or decreasing the amount you owe to the IRS.

Yes, if you donate appreciated stock held for over one year to a qualified public charity, you can generally deduct its fair market value on the date of donation. This strategy also allows you to avoid paying capital gains tax on the appreciation.

A DAF is a charitable giving vehicle that allows you to contribute assets and receive an immediate tax deduction. You can then recommend grants to charities over time. It helps by allowing you to claim a deduction in the year you fund the DAF, separating the deduction from the timing of actual grants.

If your contributions exceed the Adjusted Gross Income (AGI) limits, the excess amounts can generally be carried over and deducted in subsequent tax years, typically for up to five years. This allows you to utilize the full tax benefit of your generosity over time.

You need a written acknowledgment from the charity for cash contributions of $250 or more, and for non-cash contributions over $250. For larger non-cash donations, IRS Form 8283 and sometimes a qualified appraisal are also required for proper substantiation.

Conclusion

Strategic year-end charitable contributions are a powerful tool for both philanthropic impact and tax optimization. By understanding the various methods of giving, adhering to deadlines, and maintaining diligent records, taxpayers can significantly reduce their taxable income while supporting causes they deeply value. Whether through cash donations, appreciated securities, or Donor-Advised Funds, careful planning before December 31st is essential to unlock potential tax breaks and ensure your generosity is fully recognized by the IRS. Consulting with a tax professional can further tailor these strategies to your unique financial situation, maximizing both your charitable impact and your tax savings.