US Housing Market 2025: Expert Forecasts & Interest Rate Impact

US Housing Market Outlook: Expert Predictions for 2025 Amidst Rising Interest Rates anticipates a market slowdown due to increasing mortgage rates, influencing affordability and demand, with experts suggesting regional variations and potential stabilization towards late 2025.

Navigating the complexities of the real estate market can be daunting, especially with fluctuating interest rates. The US Housing Market Outlook: Expert Predictions for 2025 Amidst Rising Interest Rates is pivotal for potential homebuyers, sellers, and investors alike. What do the experts foresee for the housing landscape in the coming year?

Decoding the 2025 Housing Market: An Expert Overview

Understanding the trajectory of the US housing market requires a comprehensive analysis of various economic indicators and expert forecasts. The anticipated trends for 2025 are shaped by current economic conditions, projected interest rate movements, and shifting demographic preferences.

Key Factors Influencing the Market

Several factors will play a crucial role in shaping the housing market in 2025. Interest rates, economic growth, and housing supply are key determinants. Understanding these factors and their potential impact is paramount for making informed decisions.

- Interest Rates: Rising interest rates will likely continue to impact affordability and demand.

- Economic Growth: A strong economy can bolster housing demand, while a slowdown may dampen it.

- Housing Supply: Inventory levels will influence price dynamics and market competitiveness.

Expert opinions vary on the precise magnitude and timing of these impacts. However, a consensus exists on the overall direction—a market correction influenced by rising rates and affordability concerns.

Interest Rate Hikes: A Major Market Shaper

Interest rate hikes are posing a significant challenge to the housing market. These increases impact mortgage affordability, directly affecting potential buyers and sellers. Analyzing the effects of these rate hikes is essential for understanding the market’s future.

The Federal Reserve’s monetary policy plays a crucial role in setting the trajectory of interest rates. Further rate hikes can potentially lead to decreased buyer activity and price stagnation in some regions.

Impact on Mortgage Rates

Mortgage rates are directly correlated with the Federal Reserve’s policies. Here’s how rising rates affect potential homebuyers:

- Decreased Affordability: Higher rates translate to increased monthly payments.

- Reduced Demand: As mortgages become more expensive, fewer people can afford to buy homes.

- Market Slowdown: The overall housing market activity may decelerate as a result.

While rising interest rates can create challenges, they also present opportunities for those who are prepared. Buyers with strong credit and sufficient funds may be able to negotiate better deals in a less competitive market.

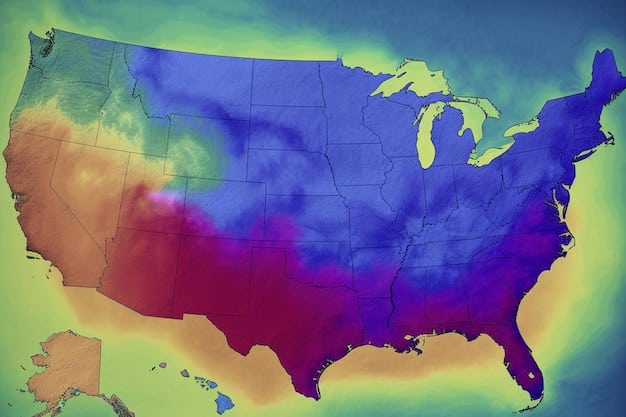

Regional Variations: Market Hotspots and Cool Downs

The housing market is not monolithic; regional variations are significant. Some areas may experience robust growth, while others could see corrections. Identifying these regional trends is crucial for investors and homebuyers.

Factors such as job growth, migration patterns, and local economic conditions play a pivotal role in determining regional housing market trends. Understanding these dynamics can provide valuable insights.

Identifying Growth Areas

Certain regions are expected to outperform others in 2025. These hotspots are characterized by strong economic fundamentals and demographic tailwinds.

- Sun Belt States: Areas like Florida, Texas, and Arizona continue to attract newcomers.

- Tech Hubs: Cities with robust tech industries often see increased housing demand.

- Affordable Markets: Locations with relatively lower housing costs may attract buyers seeking value.

However, it’s important to note that growth areas are not immune to the broader economic trends. Even in thriving markets, rising interest rates and affordability concerns can temper enthusiasm.

Affordability Challenges: Keeping the Dream Alive

Housing affordability is a growing concern for many Americans. Rising home prices, coupled with increasing interest rates, are putting pressure on potential buyers. Addressing these challenges requires innovative solutions and policy interventions.

Factors such as income stagnation, student loan debt, and limited housing supply contribute to the affordability crisis. Finding ways to alleviate these pressures is essential for ensuring housing accessibility.

Strategies for Improving Affordability

Several strategies can help improve housing affordability. These include:

- Increasing Housing Supply: Building more homes can help ease price pressures.

- Government Subsidies: Providing financial assistance to first-time homebuyers can make homeownership more accessible.

- Innovative Financing Options: Exploring alternative mortgage products can help buyers overcome affordability barriers.

While these strategies offer potential solutions, their effectiveness depends on coordinated efforts from policymakers, developers, and financial institutions. Addressing the affordability crisis will require a multifaceted approach.

The Rental Market: An Alternative Perspective

The rental market offers an alternative perspective amidst the housing market volatility. As homeownership becomes less accessible, demand for rental properties may increase. Examining the rental market dynamics is crucial for a comprehensive understanding.

Factors such as demographic shifts, lifestyle preferences, and economic conditions influence the rental market. Understanding these drivers can provide valuable insights for investors and renters alike.

Rental Market Trends

Several trends are shaping the rental market in 2025. These include:

- Increased Demand: As homeownership becomes less affordable, more people may opt to rent.

- Rising Rents: Limited supply and increased demand can lead to higher rental rates.

- Urbanization: Cities continue to attract renters seeking convenient access to jobs and amenities.

While the rental market presents opportunities for investors, it also poses challenges for renters. Finding affordable rental options can be difficult in high-demand areas.

Investment Strategies: Navigating Uncertain Times

Navigating the housing market in uncertain times requires careful planning and strategic investment decisions. Whether you’re a seasoned investor or a first-time homebuyer, understanding the current market conditions is essential.

Factors such as risk tolerance, investment horizon, and financial goals should guide your investment decisions. Seeking professional advice can also be beneficial.

Tips for Smart Investing

Here are some tips for making smart investment decisions in the current housing market:

- Do Your Research: Understand the local market dynamics before making any investments.

- Consider Long-Term Trends: Focus on long-term growth potential rather than short-term fluctuations.

- Diversify Your Portfolio: Don’t put all your eggs in one basket; diversify your investments across different asset classes.

Investing in real estate can be a rewarding endeavor, but it also carries risks. By staying informed and making prudent decisions, you can increase your chances of success.

| Key Point | Brief Description |

|---|---|

| 🏠 Interest Rates | Rising rates impacting affordability and potentially slowing down the market. |

| 🌎 Regional Variations | Different regions experiencing varying degrees of growth and correction. |

| 🔑 Affordability Challenges | Rising home prices and interest rates impacting buyer’s affordability. |

| 🏘️ Rental Market | Increased demand for rentals as homeownership becomes less accessible. |

Frequently Asked Questions

▼

Experts predict a cooling trend influenced by rising interest rates, affecting affordability and demand. The market will likely see slower growth compared to previous years, with regional variations.

▼

Rising interest rates increase the cost of mortgages, reducing affordability for potential homebuyers. This can lead to decreased demand and a slowdown in market activity.

▼

Sun Belt states and tech hubs are anticipated to perform well due to strong economic fundamentals and demographic shifts. Affordable markets may also attract value-seeking buyers.

▼

Increasing housing supply, government subsidies for first-time homebuyers, and innovative financing options can improve housing affordability. Coordinated efforts are vital for success.

▼

The rental market is expected to see increased demand as homeownership becomes less accessible, possibly leading to rising rents. Urban areas might continue to attract renters seeking convenience.

Conclusion

In conclusion, the US housing market in 2025 is poised to be influenced significantly by rising interest rates and affordability challenges. While regional variations and investment strategies can offer opportunities, careful planning and informed decision-making will be key to navigating this evolving landscape.